|

|||

Habitat Homeowner Selection Criteria You may be eligible to partner with Habitat for Humanity to buy a home through our homeownership program if you have lived or worked in Pinellas or Pasco Counties for at least 1 year and you meet the following three sets of criteria: Need for Housing (overcrowded, paying too much for rent, sub-standard living conditions, etc.). Willingness to Partner (investment of sweat equity to help build home, attend homeowner candidate education courses, pay $1000 towards closing costs, save for 1st year’s homeowner insurance). Ability to Pay (low-income partners will pay affordable mortgage payments at amounts not to exceed 30% of their gross monthly income). Need - Factors that demonstrate a need for housing:

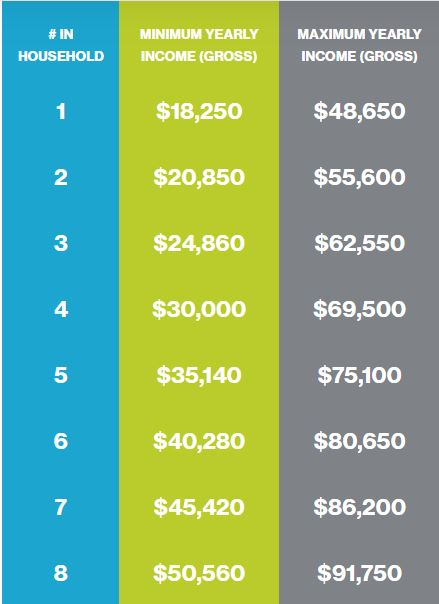

Ability to pay: Income & credit requirements:

Our calculations are made using gross income and income must be:

Sources of income that are considered include:

- Employment income – must be 1 year continuous employment at same job. - Self-employment (2-year history – must provide 2-years of Tax Returns and Profit and Loss statements). - Disability income – must be likely (and documented) to last for the next 3 years. - Child support or Alimony – must be likely (and documented) to last for the next 3 years. - Social Security - SSI - must be likely (and documented) to last for the next 3 years. - Pension - Retirement You must meet the debt-to-income ratios:

You must demonstrate an ability to meet credit obligations: - Have no non-medical debt or charge offs on your tri-merge credit report (Experian, Equifax, and TransUnion). - Have no more than $1,000 in medical debt. - If there is no credit accounts on your credit report, documentation of three credit references will be required with no more than thirty days delinquent on at least two of these references. - Have at least 4 years since bankruptcy has been discharged. - Have at least a 4 year lapse after a home foreclosure. |

|||